Trade

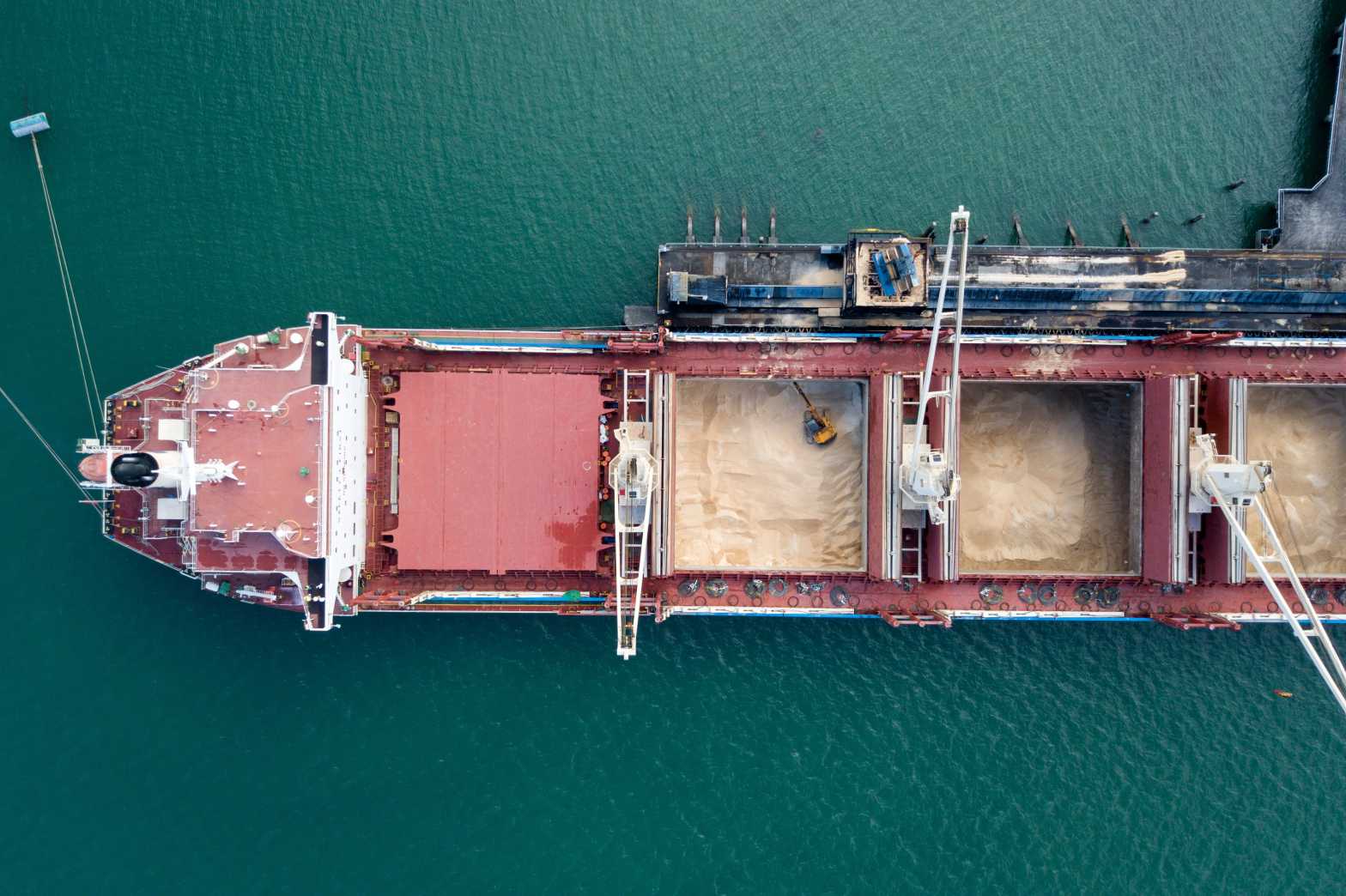

Working to improve market access opportunities for Australian sugar

Sugar is produced in more than 120 countries. In many of these countries the sugar industry is viewed as politically sensitive, resulting in a range of tariffs, import quotas, production quotas, price supports, subsidies, and other support measures. These combine to make sugar one of the world’s most distorted commodity markets.

An important strategic priority for CANEGROWERS is to improve market access opportunities for Australian sugar by substantially reducing market access barriers and reducing trade distorting domestic supports and export subsidies, distortions that adversely impact world sugar prices. Working closely with government, the strategy is twofold:

- ensure new market access opportunities for sugar are included in all new trade agreements

- ensure trade rules are enforced

Key Areas of Work: